1. Why should I franchise my business?

Franchising is probably one of the quickest ways to expand a business and build a brand. Compared to expanding a business by opening capital intensive company-owned stores, franchising provides the franchisor with the ability to expand the business regionally, nationally or globally through franchisees, who put up their own capital to start and operate the business.

2. How do I know if my business has the potential to become a successful franchise operation?

Although many business concepts can be franchised, there are some that are not viable candidates for franchising. FranCap can conduct an analysis of your business concept and evaluate the potential of your business to expand through franchising.

3. What types of businesses are best suited to franchising?

Although many types of business concepts are potential candidates for franchising, it is important to note that to become successful, a franchisor must have some degree of distinctiveness, or the potential to achieve distinctiveness, in its business segment. If it does not, it will have difficulty attracting high caliber franchisees in an increasingly competitive market for such persons. A franchise may be distinctive in terms of its products, services, operating and delivery systems or marketing. If a business is to be successfully expanded by franchising; its success must be attributable to its products or services, business format, operating or management systems and/or marketing. The elements of the success of the business must be teachable to persons with capabilities that exist among prospective franchise buyers and must be replicable by such persons. To be successful, a franchised business must appeal to high caliber franchise buyers and compare favorably with other franchises in the marketplace.

4. Why should I franchise rather than just opening additional company-owned locations?

Franchising provides business owners with a proven vehicle for quickly expanding their businesses and building their brands nationally. On the other hand, expansion through opening company-owned stores can not only take much longer, but it requires a substantial amount of capital and human resources to manage such expansion. Some companies do both; that is, sell new franchises and continue to open additional company-owned stores. In making the decision to expand a business, management must weigh the pros and cons of which expansion works best for their type of business.

5. How do you determine if my business is franchisable or not?

We believe that it is important to prepare an in-depth, objective franchise feasibility analysis that will examine both the strengths and weaknesses of the underlying business model. The feasibility analysis should include viability of the concept, profitability, market share, brand awareness and other factors. The feasibility analysis will help determine if it makes both economic and business sense to move forward with developing a franchise program or not. Knowing strengths and weaknesses before embarking on a franchise program is an indispensable first step all companies should take.

6. How does a franchisor make money on franchising?

A franchisor typically generates revenues from franchise fees, royalty fees and in some cases sales of products and services to its franchisees.

7. Do I need to develop a business plan for my business?

We recommend that every business develop a comprehensive business plan, especially if the prospective franchisor intends to seek capital from outside investors. The business plan is primarily an internal document or guide to assist in the development, operation and marketing of the business's products or services.

8. Do I need to register my trademark in order to franchise?

A franchisor must have a protectable trademark. A trademark includes trade names, trademarks, service marks, logos and other commercial symbols. Selecting such a mark involves trademark searches and a determination of the rights of other users of the same or a similar trademark. A search for potential conflicts is important because users of the same or a similar mark will have priority in their zone of use even if the franchisor's mark is ultimately registered on the Principal Trademark Register of the U.S. Patent and Trademark Office ("USPTO"). FranCap can facilitate the registration of your trademark and refer you to a competent trademark attorney to help assure that your trademark is properly registered and monitored for infringement purposes.

9. What are my responsibilities as a franchisor?

Managing a franchise program can require a significant amount of time and resources on behalf of the franchisor. The franchisor is generally responsible for site location assistance, pre-opening assistance, inventory, product or equipment sourcing, advertising campaigns, ongoing consulting services, etc. As in any business, the more attention paid to the operation, management and marketing of the business, can potentially result in significant rewards down the road.

10. How much does it typically cost to develop a comprehensive franchise program?

Generally speaking, the cost to develop a comprehensive franchise program can vary widely depending on the type of business being franchised. Other costs such as audit fees, legal fees, franchise consulting fees, state registration fees, trademark registration, preparation costs of operations manuals, marketing costs (i.e., franchise sales, marketing materials, digital marketing campaigns and other related costs. Moreover, the scope of each franchise development program can vary materially. Therefore, each program requires a detailed analysis of the estimated costs to ensure that sufficient funds are available to develop, launch and market a franchise program so that the franchisor has a good chance of being successful. Many franchise development firms in the industry charge in the range of $75,000 to $250,000, more or less, for their franchise development services. While these costs may initially seem high, a prospective franchisor should conduct a cost benefit analysis before deciding whether or not to expand the business by franchising versus developing additional company-owned locations. FranCap is one of the only franchise development companies in the industry today that offers a no upfront fee option for prospective franchisors seeking to expand their business through franchising.

11. How long do I need to have been in business before developing a franchise program?

We believe that a potential franchisor should have been in business for at least 2 - 3 years. Although each situation is different, we feel that it typically takes at least that long to determine the viability and potential profitability of a business concept.

12. What type of professional help will I need to develop, launch and market my franchise system?

It is important to choose experienced professionals who specialize in franchising. These franchise services professionals generally include: 1) franchise consultants; 2) legal counsel; 3) accountants; and 4) marketing consultants. Although FranCap is not a law firm or an accounting firm, we work with a number of attorneys and accountants that have significant experience with franchise operations and can refer them to you for your legal and accounting needs. FranCap can not only serve as your franchise consultant, but our affiliate companies can assist you with the development and management of your marketing and social media campaigns.

13. What federal and state laws and regulations must be complied with?

Complying with the myriad of federal and state franchising laws and regulations related to franchise registration and marketing practices is a trap for the unwary. Our experienced management team can assist existing and prospective franchisors in complying with federal and state franchise laws.

14. How long does it take to develop and register a franchise?

Each business is different, but generally speaking it can take at least 4 to 6 months, more or less, from start to final registration in one or more states before a franchisor can begin offering franchises for sale.

15. How long does take to sell a franchise to a prospective franchisee?

Realistically speaking, it may take anywhere from 2 to 4 months, more or less, to sell your first franchise once you launch your sales and marketing program. Further, new or early stage franchisors may wish to retain the services of a franchise broker to assist lead generation and sale of franchises.

16. What states am I allowed to legally sell my franchises?

Currently, there are approximately 14 states that require you to submit a franchise registration before you can start offering franchises for sale in those states. However, of the aforementioned registration states, there are 4 that only require you to file what are called "notice" filings before you can start offering your franchises for sale in those states. In addition, there are also approximately 36 non-registration states that require that you comply with federal FTC laws and regulations with regards to the offer and sale of franchises in those states.

17. Can I sell my own franchises or do I need to use a third party franchise broker?

The franchisor can offer and sell their own franchises without utilizing the services of a franchise broker. While there are a few good franchise brokers in the industry, there are also those that talk a big game, but come up short on performance. In addition, a franchisor that uses a franchise broker can pay commissions as high as 40% to 50% of the franchise fee. Industry sources report that the median commission franchise brokers receive for franchise placements is around $15,000. Although this cost may seem high, a new or early stage franchisor may want to retain a franchise broker until the franchisor gains additional experience in marketing and selling their franchises to prospective franchisees.

18. Is FranCap a franchise broker?

No, FranCap is not a franchise broker and does not directly offer franchise sales services to franchisors. However, FranCap can refer you to reputable franchise brokers in the industry to provide these services.

19. What type of franchise development services does FranCap provide?

FranCap is a full service franchise development firm that provides a comprehensive list of services. We can prepare all necessary franchise documents for your franchise program as well as prepare your sales materials, design your franchise marketing program, develop your advertising program, prepare your operations and training manuals and develop your training program. Our franchise development program includes everything necessary to begin selling franchises, training franchisees and operating and marketing your franchise program.

20. Can I franchise my business on my own without using a franchise development consultant?

The short answer is yes you can. However, both federal and state laws are complex and should not be taken lightly. Any major misstep could result in delays or possibly even a withdrawal of a franchise application due to deficiencies or other material disclosure issues in the FDD or related documents. Whether you decide to use our services or not, we recommend that you seek competent advice from professionals experienced in the franchise development process. The time you spend trying to develop a franchise program on your own is probably better spent focusing on managing your business.

21. Why should I use FranCap to develop my franchise program?

Our management team has extensive experience in all areas of business structure, franchise operation and marketing. In addition, the value proposition we offer to both existing small established businesses and existing early stage franchisors is to provide them with professional franchise development expertise and capital sources (if needed) that will enable them to become large national brands.

22. How is FranCap different from other franchise development services firms?

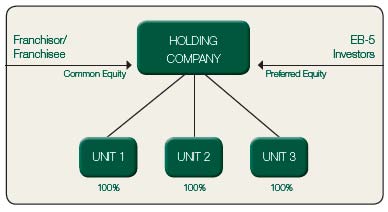

Many of our competitors offer their services only on a flat fee or hourly consulting basis. While FranCap does offer prospective franchisors the aforementioned payment options if they so choose, we also offer prospective franchisors a no upfront fee option and a deferred fee payment option. Our no upfront money option for our franchise development services frees up the cash that you may need to continue to run your business. This option is available to a select number of qualified businesses that we believe have the potential to become successful franchise operations. The compensation that we charge for this option is essentially performance based. In other words, since our compensation involves a revenue sharing arrangement with the franchisor, and possibly a negotiated equity position in the franchisor, we must work harder to ensure that the franchisor becomes successful.

23. Will FranCap finance my franchise program?

Capital is required to fund many essential elements of a franchised network, including: (1) developing, operating and modifying prototypes of the business to be franchised; (2) developing and improving operating systems, products and services; and (3) developing the network trade identity (i.e., trademarks and trade dress). A prospective franchisor seeking to develop a franchise program will typically incur substantial expenses for: (1) consulting, legal and other professional services; (2) hiring and training management and field personnel; (3) marketing and advertising; (4) compliance with the regulation of franchise sales; (5) selling franchises; and (6) performing services for and assisting franchisees. Depending on the viability of the project, FranCap may either provide capital to a qualified franchisor or introduce the franchisor to third party sources of capital. In addition, FranCap can also assist the franchisor in the preparation of the financing proposal.

24. What franchise development services does FranCap provide me?

FranCap can provide a prospective franchisor with a complete menu of franchise development services needed to develop, launch and market a franchise program. The prospective franchisor can choose from various packages of services or may wish to retain FranCap to only provide them with certain a la cart services.

25. Can FranCap provide me with ongoing consulting services?

The goal of FranCap is to ensure your success as a franchisor. To that end, we are available to provide you with ongoing consulting services as the need arises on either a monthly retainer basis (a set amount for a specific number of hours per month) or simply on an hourly basis as needed.

26. Do I need to plan now for a merger or acquisition of my business?

We believe that it is never too early to plan for the future sale of your business. To get the most money from the sale of your business you must anticipate that a potential buyer of your business will be requesting a great deal of information that will be needed to support the sale price of the business. Preparing for the due diligence process can be very time-consuming and you will need to provide many documents for review by a potential buyer. Further, it is important for a franchisor to keep in mind the impact of a sale on shareholders, management, employees, franchisees and the overall health of the brand. In order to be adequately prepared, the franchisor must start early and consider what information would be needed by the prospective buyer (whether an institutional investor, private equity or other entity).

27. How do I get started with FranCap?

We can be contacted by phone, email or fax to answer any questions that you might have. If there is further interest on your part after your initial contact with us, we can schedule a personal meeting with you at our executive offices in Woodland Hills, California to meet our management team and discuss the franchising potential of your business. However, not every business is a viable franchise candidate for a number of reasons. Even if your business is considered to be franchisable, it may be too premature to develop your franchise program today, in which case, we can provide you with the assistance to prepare your business for franchising at a later date. Making the decision to grow your business through franchising should not be taken lightly. We can help you in evaluating whether or not this is a direction that you should go. Since our objective is to assist our clients to become successful franchisors, we typically only choose to work with potential franchisors whom we believe have the potential to become large national brands.